of Our Services

How Can A Financial Advisor Help?

As you get older, your life changes: priorities shift, life gets busier and, as you accumulate more wealth, your financial goals and options become more complicated.

A financial advisor can save you time and hassle and help protect and grow your assets.

“We know you’re smart enough to do this on your own, you just don’t want to.”

– Bill McCance, president and CEO of TAG

But, google “financial advisor” and you will get almost 2 billion results. How do you choose the right one? Watch our video “All Financial Advisors are the Same. Aren’t They?” to see how TAG stands out.

The Trust Advisory Group Difference:

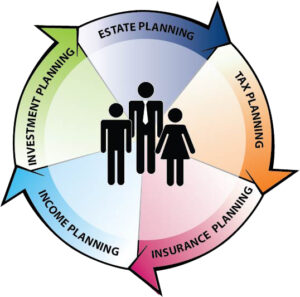

Grow and Protect Your Assets Through A Holistic Approach

Our priority is helping you take financial care of yourself and your family. We start by learning more about your personal situation, your dreams and goals, and your tolerance for risk so we can create a financial planning program customized to you.

TAG meets you where you are now to map out your financial future – there is no minimum account size required to join.

Our advisors support a holistic planning approach based on widely accepted principles and standards in the financial planning community and are committed to lifelong learning, so you benefit from the most current practices.

Whether you choose to use all – or some – of the services we offer, TAG works with you to protect and grow your assets.

At TAG, The Client Comes First, The Advisor Second, The Firm Third

Believe it or not, this philosophy is the exception in the industry rather than the rule.

But it is our deep-rooted belief that caring, empathy, support and a personal touch should be the foundation of all client relationships. Our advisors are just like you – they have goals and dreams, too, and understand what it takes to help you with yours. It’s the interaction with actual humans that makes us different.

Best of all, we are not beholden to a large Fortune 500 company or behemoth Wall St. firm. We have the knowledge and training to do what’s right and we care enough to do it. TAG TEAMs always act in your best financial interest: if it doesn’t further your goals and objectives, we won’t do it.

6 Steps To Managing Your Financial Future

- Understand your current financial situation and identify your needs and goals.

- Prioritize the goals to be addressed in your personalized Financial Plan.

- Create a written agreement outlining our planning relationship, which is always crafted with your best financial interest in mind (not ours!)

- Gather all necessary supporting documents for review.

- Evaluate potential solutions and develop customized recommendations for your approval.

- Implement agreed upon solutions and monitor results and effectiveness of the plan, periodically adjusting as your goals and priorities change.

Our Services:

Personalized Financial Planning

Similar to a blueprint or a roadmap, a comprehensive financial plan starts with your financial dreams then takes a big-picture look at your overall financial situation and maps out a path to achieve them.

Money Management & Investing

We are committed to demystifying the investment process and keeping you as involved as you’d like to be.

Risk Management & Insurance

A comprehensive risk management plan protects the value of your wealth and ensures your loved ones will be taken care of in the case of unexpected life events.

Trust and Estate Planning

Planning for what happens to your estate should be an integral aspect of your overall financial management strategy, even when you’re still young. TAG requires no minimums and will work with you at whatever stage of life you currently are.

Inheritance Planning

Inheriting a legacy, whether expected or unexpected, brings with it a certain amount of responsibility. Our Team understands the special nature of Transgenerational Wealth Planning™.

Work With Us

Whether you join TAG with your existing advisor or as a new client on your own, our level of service and commitment to your financial success is the same. Contact us today to get started.