The Next Generation Of Financial Management

The world has changed a lot since Black Monday sent the stock market into a tailspin in 1987. From fintech to block chain and crypto currency, the financial industry is being reinvented every day.

At Trust Advisory Group (TAG), we think it’s time the financial management business was reinvented, too. That’s why we created TAG 2.0

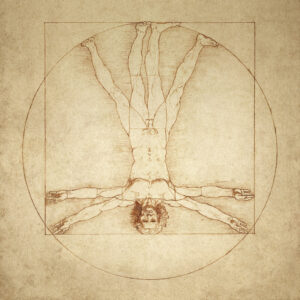

Standing The Old Model On Its Head

TAG 2.0 is a new take on financial advisory services that combines the best of all worlds: the fresh thinking, creativity and enthusiasm of a start-up division; the friendly, family atmosphere of a small firm, and the security and stability of a 30-year-old institution (TAG Group, Inc.). TAG 2.0 infuses old-world morals and ethics into the next generation of financial advice.

TAG 2.0 is a new take on financial advisory services that combines the best of all worlds: the fresh thinking, creativity and enthusiasm of a start-up division; the friendly, family atmosphere of a small firm, and the security and stability of a 30-year-old institution (TAG Group, Inc.). TAG 2.0 infuses old-world morals and ethics into the next generation of financial advice.

At TAG, we won’t force you to adapt to our way of doing business, we’ll adapt to yours. And forget the typical sales-y, impersonal, indifferent advisor who hides in his expensive office. Bring on financial professionals that are human, authentic and engaged in each client relationship.

With the TAG 2.0 model, we set out to turn the traditional Wall St. advisory model on its head and break out of the stuffy old mold.

What Sets Us Apart

TAG is a financial management firm that provides clients in all stages of wealth development independent, unbiased financial advice steeped in traditional morals and ethics. And we offer all the traditional Financial Planning, Investment Management, Wealth Protection and Wealth Management services that other firms do, but in a non-traditional model. See what sets us apart:

Main St. not Wall St. We don’t answer to a Fortune 500 company, we answer to our clients. We always put the client first, the advisor second and the firm third.

Main St. not Wall St. We don’t answer to a Fortune 500 company, we answer to our clients. We always put the client first, the advisor second and the firm third.

Traditional Values not Stodgy Traditions. We embrace the most meaningful traditions of the past – caring, empathy, support, and a personal touch – but live in the present and have our eye towards the future with the use of state of the art technology tools.

The Highest Moral and Ethical Standards. This one needs no explanation; we just do what’s right.

Communication on Your Terms. We don’t hide behind technology; we use it to deliver a customized client experience. Everyone’s a little different: some want an entirely online experience, others may prefer to meet face-to-face; some want to text their advisor, others prefer a phone call. It’s up to you!

No Double-Speak. We tell it like it is, in plain English; no “investment-splaining” here. We know that, while you could manage your money yourself, you’d rather have someone else do it for you so you can enjoy life. You’d love to find someone you can trust to do the right thing, and know they have the experience to do it right.

No Minimums, No Maximums. At TAG 2.0 we have no dollar threshold for those who work with us; join the TAG TEAM and grow with us.

No Minimums, No Maximums. At TAG 2.0 we have no dollar threshold for those who work with us; join the TAG TEAM and grow with us.

Commitment to the Community. Corporate responsibility is in our DNA. TAG is committed to becoming involved, together with our Teams, in causes such as financial literacy, hurricane relief, ending hunger, and other causes close to the hearts of those we work with.

A Dedicated TAG TEAM. Succession planning is often not so much a plan as it is a hasty reaction to an unexpected event. But with your own TAG TEAM in place, there’s no need to worry about what might happen in the future; we’ve got it covered.

The TAG TEAM Model: A Win-Win-Win

The TAG TEAM model is an innovative approach to managing the future of financial advising. TAG TEAMs have a built-in mechanism to develop fresh talent and seamlessly transition advisors, clients and their assets to ensure continuity and peace of mind for everyone involved.

Our TAG 2.0 Wealth Associates work alongside one of TAG’s 100+ seasoned advisors who have been personally managing their client relationships for years, sometimes decades. These advisors have built their business on good old-fashioned values, hard work and performance, and are too invested in their client relationships to simply hand them off to a stranger. Not until the time is right will they hand off the baton to the Wealth Associate they have mentored. Who better to teach the next generation of advisors the right way to do it?

Read more about our TAG TEAM Model and how it’s a win for Advisors, a win for our Wealth Associates, and a win for Clients.